The future of financial technology assures groundbreaking developments that will certainly redefine the worldwide financial landscape. With rapid advancement and growing fostering, fintech is positioned to provide extraordinary changes to monetary solutions and consumer experiences.

One location of focus is the advancement of extremely apps that combine numerous financial solutions right into a single system. These applications aim to enhance customer experiences by providing a one-stop purchase banking, investing, budgeting, and repayments. Currently popular in Asia, incredibly applications are expected to get grip globally as financial institutions and technology companies collaborate to use thorough services. By integrating ease with personalisation, super apps deal with the modern-day consumer's demand for simpleness and performance. However, their rise likewise questions concerning data privacy and monopolistic methods, which will certainly call for careful oversight.

Another considerable pattern forming the future is the surge of biometric authentication for securing deals. Face acknowledgment, finger print scanning, and voice recognition are changing traditional passwords, offering improved safety and ease. These modern technologies are particularly valuable in avoiding scams and unsanctioned accessibility, resolving among the biggest concerns in digital finance. As fintech companies integrate biometric services into their platforms, they will need to navigate difficulties such as accuracy, availability, and honest factors to consider. Stabilizing safety with customer depend on will certainly be crucial to the prevalent fostering of these modern technologies.

Ultimately, fintech is anticipated to play an important duty in resolving read more financial inequality with customized monetary services. Microfinance platforms, community-based investment tools, and accessible credit history systems are equipping underserved populations. By leveraging data analytics, fintech companies can provide personal items to people with restricted credit rating, opening doors to economic opportunities. This approach not just drives economic incorporation however likewise fosters long-term financial development. As the market develops, its ability to address international obstacles while preserving development will specify its heritage.

Molly Ringwald Then & Now!

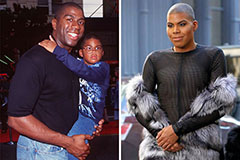

Molly Ringwald Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!